Climate change and congestion concerns have shifted the political and social agenda toward livability and sustainability measures in many economic centers. These shifts impact the deployment of smart mobility solutions within urban areas in many different ways. Each metropolis has specific and unique challenges, barriers, solutions, and enablers that we will review in this new series of case studies about Urban Mobility.

We start our series with one of the world’s oldest megacities, and the most populous city in Europe – London.

London faces a series of key challenges that might suggest it’s an ideal petri dish for Smart Mobility solutions, and indeed many transport and mobility innovations have successfully grown out of the United Kingdom’s capital city.

Eugenio Herrero is a Manager at Amey Investments with a research focus on mobility-as-a-service. He highlights three environmental, social, and organizational issues specific to this growing megacity. First, he stressed the critical pollution level which can – on some days – be as bad as most major Asian cities (i.e., Beijing or New Delhi). Second, the average commuting time for Londoners is 74 minutes per journey, almost twice the global average; more often than not, public transport is the most efficient way to traverse the city. Finally, what we call “London” is actually an aggregation of a multitude of “boroughs,” which have the power to regulate mobility-related issues such as parking allocation and revenue independently.

In London, policy initiatives directly impacting people [and their wallet] such as the Ultra-Low Emission Zone, the Congestion Charging zone, and emissions-based parking costs are constantly pushing people to explore new mobility solutions and adapt their transportation behavior. This means that less than half of Londoners own a car, and a fleet of over 40,000 private-hire vehicles (mostly Uber, Addison Lee, and more recently Bolt, Kapten, and soon, Ola) add to the over 20,000 taxis on the road.

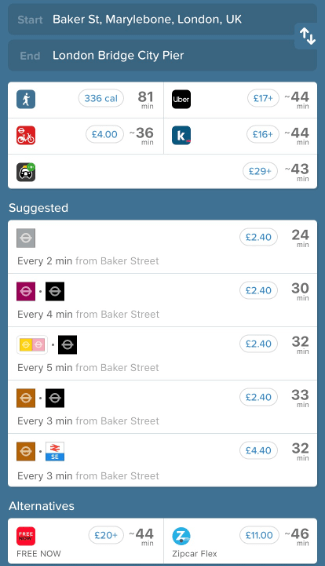

Mobility options range from efficient public transport, including the world’s oldest underground (operating since 1890), to a massive fleet of iconic red double-decker buses, and a large number of private mobility operators offering ridehailing, bikesharing, and carsharing solutions. Indeed, public transport and bicycling can often be faster than taking a car, especially if the search for a parking spot is to be included. Unusually among megacities, however, e-scooters are not yet part of the London landscape as the use of these vehicles is still forbidden.

“Carsharing has not been successful in the UK for cultural and policy reasons. However, there is some evidence of success around the point to point approaches, such as corporate carpooling.” Mark Saunders

However, not all mobility solutions have been successful in London. Daimler’s original carsharing service, Car2Go, pulled out of London in 2014, and BMW’s DriveNow followed suit, just weeks after its rebranding (to ShareNow) in 2019. Bollorés three-year experiment with electric Bluecity vehicles will end in 2020. Key issues for free-floating carsharing providers have been the complexity of operations across boroughs. Rather than a single point-of-contact, carsharing providers have needed to manage relations with 32 different entities; they have also not been able to consistently roll-out carsharing services across all parts of the city – leaving customers with a degree of uncertainty, rather than a seamless experience. Mark Saunders, Director for the Centre of Excellence for Cities at Ferrovial Services, a Smart City solutions provider, explains that “to be profitable a carsharing system needs to expand extremely fast and extremely selectively in a large number of different cities where you treat each one of them uniquely due to their local differences”.

Rental car companies have had more resilience, especially with station-based systems: Enterprise and AvisBudget’s Zipcar continue to operate across much of London. Similarly, various types of organizations across the UK have embraced corporate carsharing to replace their pool cars or to give additional mobility options to their staff.

For Londoners, already spoiled for choice, carsharing vehicles must be available within a reasonable distance, as well as flawlessly maintained and cleaned. To achieve profitability, an operator needs to balance this customer expectation against a need for a high fleet utilization rate and efficient operations. Knowing when vehicles are and will be available, and when they can or need to be taken out of service briefly is the difference between success or failure. Ridecell’s technology enables operators to optimize these most critical elements of their operation.

“London is perhaps the only city which wants to control everything in terms of mobility” Eugenio Herrero

The coordinating entity, and the local catalyst, pulling strings on innovative mobility is Transport for London (TfL). As James Datson, Principal Technologist at the Connected Places Catapult, notes, “TfL is probably unique to London.” We would suggest that this entity represents the main challenge but also the key enabler for smart mobility services. London city council, and specifically TfL, said Mr. Herrero, “have developed a significant control on everything that moves in the city and there is no new service implementation prior to the approval of the public authority.”

However, Mr. Datson also notes: “Developing policy and strategies that capture complex stakeholder needs, is a real challenge. Transport system performance KPIs that are mode-agnostic can help cut through some of this complexity e.g., the number of people moved per sqm per hour, but we must remember that mobility policy is not the only policy driving planning and investment decisions in London.” Another opportunity for improvement lies in the ability of TfL to be the facilitator when mobility companies discuss with the boroughs for a homogenous, fast, and efficient deployment.

“London has been the target for many ridehailing businesses when entering the UK market” James Datson

London certainly still has a lot to do in terms of smart mobility deployment, but the city has earned its merits. The city center is expected to be fully electrified by 2030 which would bring a boost to air quality improvement. It continues to attract new mobility players such as India’s Ola. And, the proactive local authority policies, as well as an open-data approach spurs on innovation and earns London its place amongst the leaders in driving a more sustainable future.

Author: Mark Thomas, VP of Marketing and Alliances, Ridecell